- Reliance Jio Infocomm will acquire Bharti Airtel’s spectrum in Andhra Pradesh, Delhi and Mumbai circles as it looks to expand its network capacity.

- Jio has signed a definitive acquisition agreement with Bharti Airtel for the spectrum in the 800 MHz band.

- Jio will acquire 3.75 MHz in Andhra Pradesh, 1.25 MHz in Delhi, and 2.5 MHz in Mumbai.

- The addition of spectrum will help Jio enhance its network capacity and bolster its footprint in the telecom.

- On the other hand, Airtel will reduce its ongoing financial burden through the amount it will receive from Jio, which is subject to approvals.

Bharti Airtel on April 6th, 2021, announced an agreement with Reliance Jio Infocomm to transfer the ‘Right to Use’ of Airtel’s 800 MHz spectrum in Andhra Pradesh (3.75 MHz), Delhi (1.25 MHz) and Mumbai (2.50 MHz) to Jio. The agreement is subject to statutory approvals.

Through this agreement, Airtel will get Rs 1037.6 crore from Jio for the proposed transfer. Also, Jio will assume future liabilities of Rs 459 crores relating to the spectrum.

Gopal Vittal, MD(India and South Asia), Bharti Airtel said: “The sale of the 800 MHz blocks in these three circles has enabled us to unlock value from a spectrum that was unutilized. This is aligned to our overall network strategy.”

Reliance Jio will now double its spectrum in the Mumbai, Andhra Pradesh and Delhi circles to 30 MHz, 20 Mhz and 20 MHz, respectively. Thereby further consolidating its spectrum footprint in these circles.

“The trading agreement is as per the Spectrum Trading Guidelines issued by the Department of Telecommunications and is subject to the requisite regulatory and statutory approvals. The aggregate value for the right to use this spectrum is ₹1,497 crores, inclusive of the present value of associated deferred payment liability of ₹459 crores.” -Reliance Jio added.

The enhanced spectrum footprint, especially contiguous spectrum, along with superior infrastructure deployed, will further increase Jio’s network capacity -Jio said. The transaction is subject to the requisite regulatory and statutory approvals.

In March, Jio had emerged as the highest bidder in the 4G spectrum auction, leaving behind Airtel and Vodafone Idea. It had acquired the “right to use” spectrum in all 22 circles across India by acquiring spectrum in the 800 MHz, 1800 MHz, and 2300 MHz bands. Jio had acquired 488.35 MHz of airwaves for Rs 57,122.65 crore.

The 800 MHz spectrum, which initially used for the wireline services, has been considered by telecom for 4G LTE networks across India. However, operators including Airtel and Vi in recent times had shifted their focus towards newer bands.

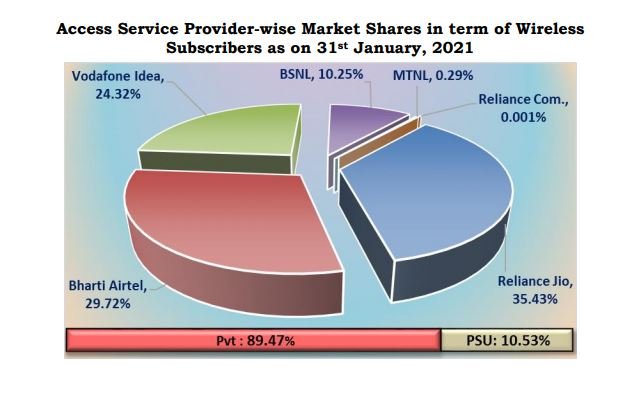

Monopoly in the Telecom Sector?

Reliance Jio has increased its network capacity with the enhanced spectrum footprint, especially contiguous spectrum, and superior infrastructure deployed. Jio is the only network that has been conceived as a Mobile Video Network from the ground up and supporting Voice over LTE technology.

Reliance Jio was the biggest bidder in the recently held spectrum auction by the Department of Telecommunication, India. It acquired 488.35 MHz of spectrum for ₹57,122.65 crores. The majority of the auction payout by Jio will be for the spectrum in the 800 MHz bands for ₹34,491 crores. Bharti Airtel bid for 355.45 MHz of spectrum for ₹18,698.75 crores. For Vodafone Idea, the value of spectrum bought in auctions was at Rs 1,993.4 crore.

Recent spectrum auction shows that India is moving towards a monopoly in the telecom sector. Reliance Jio is increasing its share in the market day by day. It’s continuously working on expanding its network connectivity all over India. Whereas other telecom companies are playing safe by limiting their capability and capacity to provide their network service.

If we recall, there used to be many telecom operators working in India before the launch of Jio. At that time, the data packs and voice packs were expensive from now. Indeed, the data revolution from Jio closes the shutter of many operators in India.

Vodafone and Idea merged as VI (Vodafone-Idea) to survive in the Indian market. Whereas Airtel and BSNL are struggling to survive in the Indian market by selling their spectrum to Jio. And the Government of India is trying to sell BSNL. No one is interested in acquiring BSNL. BSNL still provides a 2G and 3G network and not focusing on establishing a 4G network. Whereas, Jio, Airtel and VI have started testing 5G.

In recent times, Indian Telecommunication Companies are going through major changes as they all are focusing on the 5G network. Let’s see how this spectrum trading between Jio and Airtel impact the Indian telecommunication market. And how consumers will receive benefit from this deal.